Taiwan s 5,000 major enterprises closed at a new high! AI assists Taiwan s power to win the profit king, and Chengcai returns to the top ten

According to the latest "2025 Taiwan Large Enterprise Ranking TOP5000" published by CRIF China Institute of Information Technology, despite the inflation and the US-China trade war in the past year, interest rate cuts in the United States and the rapid rise of AI have given new development opportunities in 2024. With NVIDIA as the core, combining Taiwan's advanced chip process with NVIDIA, driving the entire AI supply chain, making Taiwan the biggest beneficiary.

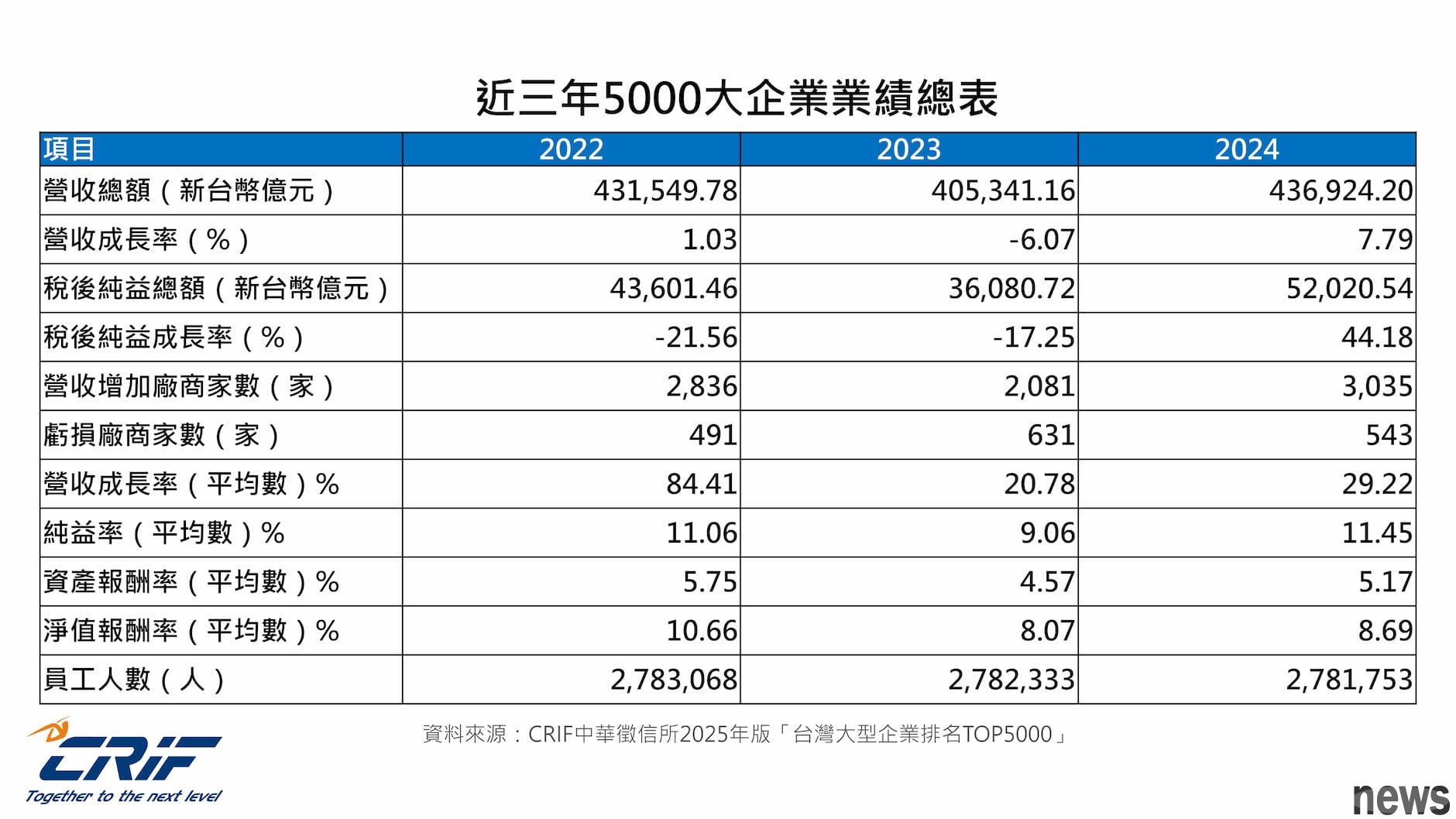

The total amount of Taiwan's 5,000 major enterprises in 2024 was a record high of 43.692.4 billion yuan, the second highest after taxes was 5.202.1 billion yuan, and the growth rate was as high as 44.18%, close to the 5.558.7 billion yuan found in 2021. The average pure yield rose to 11.45%, the average net value return rate reached 8.69%, and the average asset return rate increased to 5.17%, with a total performance outstanding.

Compared with 2023, there were no new competitors in the top ten companies with net income in 2024, only the top ten companies rebounded from 11th to 10th. The other nine companies are all associates, including Dunghai, NTU, Guangda, CNPC, Hebei, Labor and Insurance Bureau of the Department of Labor and Insurance Bureau of the Department of Labor and Insurance Bureau of Taiwan Power, Taiwan Power and Renbao. Among them, the total revenue of the Department of Labor and Insurance Bureau of the Department of Labor and Insurance Bureau of the Department of Labor and Insurance Bureau of the Department of Labor and Insurance Bureau of the Department of Power in Taiwan reached a new high.

The top ten companies after tax benefit were fully profited, and the semiconductor company Longtou Tel.com once again set a record high of 17.33 billion yuan with a tax benefit of 17.33 billion yuan, and continued to win the profit king in 20 years. The second place was 15.27 billion yuan for Donghai, the third place was 15.09 billion yuan for Fubonjin, the fourth place was 13.95 billion yuan for Changronghai, and the fifth place was 11.12 billion yuan for Guotaijin.

CRIF reminds that although the development of AI has driven global economic recovery, there are still many global economic changes and challenges, including the United States, and other taxes. The traditional economic forecast model has difficulty predicting the trend of economy, especially Taiwan's strong fundamentals in the global AI industry, which will make the exchange rate of the new Taiwan currency face the long-term pressure of "it is difficult to buy and there is room for appreciation". Enterprises need to prepare for the operation of enterprises.

CRIF analyzed that although the overall operating data of 5,000 companies in 2024 looks good, it is actually in a situation where "production performance is very different" and "extremely unbalanced". In the past seven years, the 5,000 companies have experienced a decline in their business growth in two years, and the harvest growth in two years is a low growth of less than 3%, and only two years have achieved unregulated shocks of more than 5%.

It is worth noting that CRIF found that in the past decade, the number of new players in the top 500 companies in the top 500 companies has been declining year by year, and the number of new players in the two consecutive years has decreased to one place. In 2024, there were only 4 new companies in the ranking of the 500 companies, and 3 were reduced from 7 companies in 2023, again showing that there are limited players who will compete in the future.

It is worth noting that the exchange rate of NT$ is the exchange rate. Since Taiwan has good fundamentals in the electronic technology industry and is affected by the weakness of the US dollar, NT$ is often the strongest currency of Asia. Since the United States will have two chances of interest rate cuts from the third quarter of this year to the end of the year, NT$ may not be easy to invest, but there is room for appreciation, and the exchange rate will not be limited to the industry, which will also bring the threat of exchange rate to large-scale manufacturing.

CRIF emphasizes that Taiwan’s 5,000 major enterprises should continue to invest in research and development innovation, stabilize the global supply chain core, and diversified technology investment, and make a good "five continuous" layout, including "continuous investment in the local area", "continuous control of overseas production capacity", "continuous development of non-US market", "continuous control of key raw materials sources" and "continuous avoidance of China's Red Sea market", to ensure the basic ways of economic development in Taiwan.

Extended reading: China's three major silicon crystal circle suppliers can grow rapidly! Foreign asset estimates can meet 36% of China's demand in 2027 Create and enable Zhubei AI servers the world's largest manufacturer! Huang Rensha video congratulations and Lin Fengyan shouted the symbol of national power GB200 and HGX will be stored and Meta will be aggressively promoted to ASIC! Foreign-invested beneficiary manufacturers