AI to carry silicon photonics demand tower semiconductor Q2 Wang stock price 14%

Israeli crystal foundry foundry operator Tower Semiconductor released its latest financial report on August 4, benefiting from the technical demand of AI-powered silicon photonics. The second quarter's performance was better than expected, and at the same time, it released an excellent third quarter financial test, which stimulated a 14% stock price that day.

According to the financial report released by the Tall Tower semiconductor, in the second quarter of 2025 (as of June 30, 2025), the annual closing price increased by 6% to US$372.1 billion, better than the expected US$371.6 billion on Huaer Street; after deducting a one-time profit, the adjusted earnings per share was US$0.50, which also exceeded the expected US$0.43 on Huaer Street.

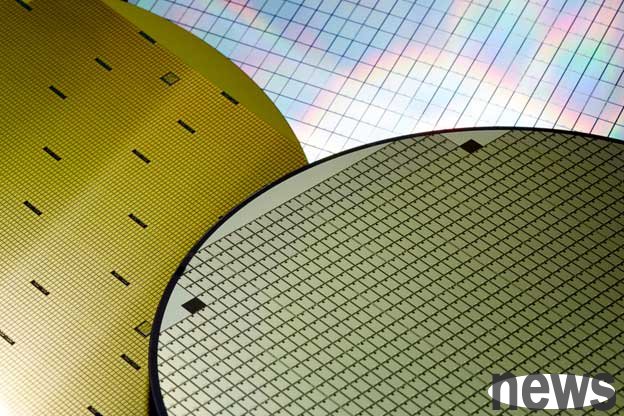

(Source: tower semiconductor)

Looking ahead to the third quarter, the tower's semiconductor company estimates that the single quarterly revenue will reach US$395 million, up and down by 5%, slightly higher than the expected US$392.5 million on Huaer Street. It is mainly optimistic that the demand for data centers and AI will continue to expand, and the demand for RF radio components will increase simultaneously, and the infusion of operation is expected.

Gaota Semiconductor is a professional semiconductor manufacturer with a large number of locations in Israel. It specializes in the production of semiconductor products for customers and is used in consumer electronics, PCs, communications, automobiles, industrials, medical equipment and other products.

On August 4, Gaota Semiconductor ADR stock price rose 14.13% and closed at $50.98, down 1.03% this year.